Many times a question arises in our mind that if a country is drowning in debt, then why doesn't that country simply print a lot of money and pay its debt. Why doesn't the government make everyone rich by printing a lot of money? All these questions seem very interesting and quite funny as well. But all these questions have only one short answer, "Printing more money just makes money less valuable". Because printing more money does not make more goods and services. It only spreads the value of existing goods and services around a large number of dollars. And we also call it inflation. But have you ever thought that whenever we think about buying something, the first thing that comes to our mind is money? Because money is a means through which we usually buy something. It is generally a medium of exchange, a widely accepted token which can be exchanged for goods and services. But how did people buy things when the money was not invented yet? You will be surprised to know that many years ago when there was no existence of money, then there was no such thing that you could buy anything by giving. At that time humans used the Barter System, which was an old method of exchange where participants in a transaction directly exchange goods or services for other goods or services without using a medium of exchange, such as money. The history of bartering dates all the way back to 6000 BC. But the barter system also had many limitations too, the first limitation is, in a monetary economy, money plays the role of a measure of the value of all goods, so their values can be assessed against each other, but this role may be absent in a barter economy. It's another limitation is difficulty in storing wealth, because some barter economies rely on durable goods like sheep or cattle for this purpose, then storing wealth for the future using this technique may be impractical. The cows, sheep, camels and other animals were used in this barter system, meaning that these animals were used as money for the exchange of goods. But traveling with these animals to far off places was very difficult. So here was the reason that money was invented, one such thing that everyone wants and which is portable too.

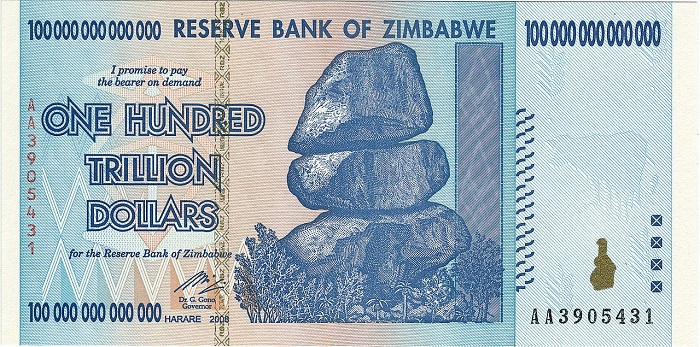

There have been many such reports in real life, which suggest that printing lots of money is not a bad idea but the worst idea. Zimbabwe is one country that has experienced significant hyperinflation in November 2008, reaching a monthly inflation rate of approximately 79 billion percent. It was a period of currency instability in zimbabwe and therefore inflation nearly doubled every day - goods and services prices were doubling every 24 hours. In 2009, Zimbabwe stopped printing its currency due to rampant hyperinflation. There were many economic shocks that were the cause of Zimbabwe’s hyperinflation. The national government increased the money supply in response to the rising national debt, there were significant declines in economic output. Country reports described that due to hyperinflation the price for a loaf of bread rose from $2 million to $35 million overnight. The government famously printed banknotes of 100-trillion-dollar in a vain attempt to make carrying cash convenient that was worth about USD 30 then. Hyperinflation in Zimbabwe spiraled out of control, causing the currencies from other countries to be used as a medium of exchange instead of the Zimbabwean dollar.

Hyperinflation

Now again let's talk about the same question that we had asked above; Why doesn't the government make everyone rich by printing a lot of money? But making everyone rich will only increase the quantity of money but its value will be reduced and the price of things will increase. Because printing more money, the resources that exist on earth will not increase. So if money increases and everyone becomes rich, the demand for things will also increase, but due to limited resources, their prices will also increase which will increase the rate of inflation very quickly and will give rise to hyperinflation, a situation where the prices of goods and services rise uncontrollably. Hyperinflation commonly occurs when there is a significant rise in the money supply that is not supported by economic growth. And that's why the government cannot solve the problem of debt, poverty, unemployment or any problem related to money by printing more money. The government can take the country on the path of progress by developing it from all sides, whether it is in the matter of education or in the actual growth of different sectors. A very famous quote indicates - "If money grew on trees it would be as valuable as leaves".Hyperinflation in Zimbabwe

Hungary’s Hyperinflation

A 100 million Bilpengo banknote issued during the Hungarian hyperinflation in 1946. The highest denomination of banknote ever issued

Image Credit - Wikipedia

But the case that comes at number one is from a country named Hungary, which was the worst case of hyperinflation ever recorded after the hyperinflation in Zimbabwe. Hungary's hyperinflation occurred in 1946 when the daily inflation rate was at over 200 percent, with prices doubling approximately every 15.6 hours. According to the natural inflation of a well-developed country, the price of things in a country is double after 24-25 years, which means that if a person buys something today in 5 lakhs, then its price will be 10 lakhs after 24-25 years. But in Hungary, it was happening every 15 hours which is considered to be the worst situation for any country. Pengo was the currency of Hungary during that time, which was introduced in 1927 by replacing the Hungarian korona. In 1944, the highest banknote value was 1,000 pengo. By the end of 1945, it was 10,000,000 pengo, and the highest value in mid-1946 was 100,000,000,000,000,000,000 pengo. When the pengo was replaced in August 1946 by the forint, the total value of all Hungarian banknotes in circulation equaled the value of one one-thousandth of a US Dollar.

But the case that comes at number one is from a country named Hungary, which was the worst case of hyperinflation ever recorded after the hyperinflation in Zimbabwe. Hungary's hyperinflation occurred in 1946 when the daily inflation rate was at over 200 percent, with prices doubling approximately every 15.6 hours. According to the natural inflation of a well-developed country, the price of things in a country is double after 24-25 years, which means that if a person buys something today in 5 lakhs, then its price will be 10 lakhs after 24-25 years. But in Hungary, it was happening every 15 hours which is considered to be the worst situation for any country. Pengo was the currency of Hungary during that time, which was introduced in 1927 by replacing the Hungarian korona. In 1944, the highest banknote value was 1,000 pengo. By the end of 1945, it was 10,000,000 pengo, and the highest value in mid-1946 was 100,000,000,000,000,000,000 pengo. When the pengo was replaced in August 1946 by the forint, the total value of all Hungarian banknotes in circulation equaled the value of one one-thousandth of a US Dollar.

Scarab Symbol (¤)

You might not know that there is a sign called Scarab (¤), which is a character used to denote an unspecified currency.

0 comments:

Post a Comment